Strap In, Startups: The Legal Hunger Games Begin

Congratulations, future unicorn (or future tax write off)! You’ve finally set down the TikTok doom scrolling, ignored three family calls and decided it’s time to make your vision legally legitimate. But wait legal structure?! Suddenly you’re faced with deciding between the LLC everyone on Reddit swears by, or the S Corp which sounds suspiciously like a rejected Marvel superhero. Your wallet is sweating. Your brain has tabs open from Stripe, Investopedia and your cousin’s side hustle blog from 2017. Welcome, founder: this is your LLC vs S Corp moment and yes, it’s as glam as filing your first W 9 at 2am. Buckle up, grab some cold brew and prepare for a legal ride that’s part Hunger Games, part The Office rerun.

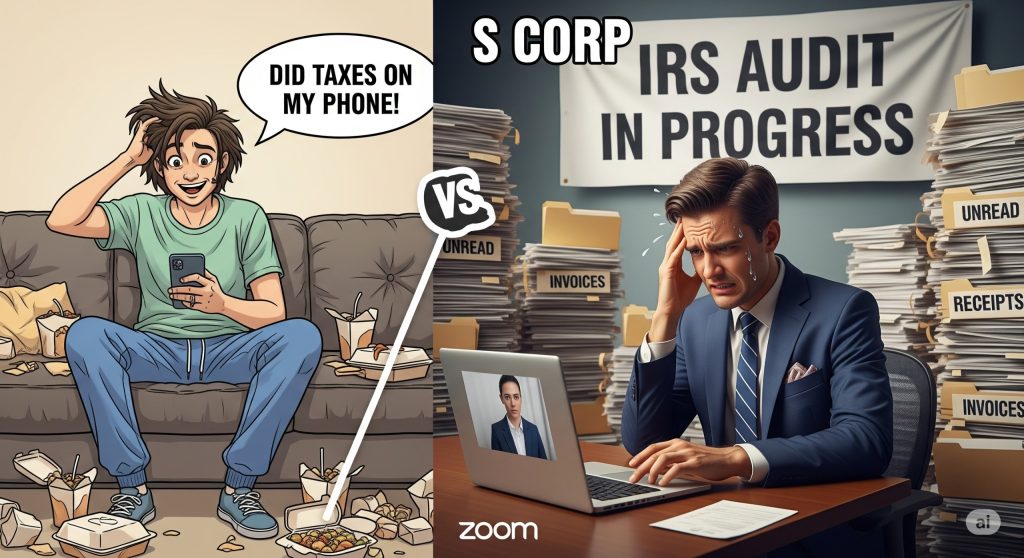

S Corps: The I Want to Be Fancy But Can’t Have Nice Things Choice

Here’s the thing about S Corps: they make you feel like a grown up until you realize the IRS treats them like that one relative who can’t RSVP on time with relentless scrutiny and weird rules.

The reality:

- You must hold shareholder meetings. Meaning: you, your dog and those weird minutes you keep forgetting to type up.

- There can only be 100 shareholders, all U.S. citizens or residents. Sorry no crypto bros from Belgium allowed.

- Pass through taxation, they say, but only if you pay yourself a reasonable salary (not $1/year so you can flex on Twitter).

- Strict formalities. S Corp paperwork wouldn’t last one day on a Starbucks counter before getting soy latte stains.

Want your business structure to feel like senior year prom rules? Congratulations, S Corp is your jam!

LLCs: The Legally Chill Roommate That Might Forget to Pay Rent

LLC time! Forming an LLC is like deciding your business will always wear athleisure ridiculously comfortable, mostly informal and occasionally presentable at Thanksgiving.

The delight:

- Flexible ownership. Bring all your friends (even international ones sorry, S Corp), your cat and that emotionally supportive barista.

- Minimal paperwork. Forget shareholder meetings; most states barely care if you wear pants.

- LLC alert: asset protection. Your PS5, laptop and collection of NFTs are safe from Karen’s lawsuits.

Moral of the story? LLCs are the business equivalent of putting everything in a Venmo note and calling it lunch.

But Which One Saves Me More Money? (AKA, The Only Thing You Care About)

Welcome to the startup circle of hell: taxes! Both LLC and S Corp are pass-through entities, which is IRS code for, Let’s see how much stress you can handle before switching to C Corp out of spite.

- With the classic LLC setup, your business income jumps right onto your personal tax returns like an entitled roommate borrowing your Hulu login.

- S Corps get spicy: you pay yourself (with payroll, no less; sorry freelancers), and may dodge some self employment taxes because loopholes are America’s favorite sport.

- However, the IRS demands a reasonable salary. Try $30,000 for your SaaS startup and see what happens (spoiler: just don’t).

Still confused? So are most CPAs. Just remind yourself: paperwork is the one thing that never goes out of style (unlike your hot takes on X).

Founders, Friends and FOMO: Ownership, Flexibility and the Painful Truth

LLC flexibility is legendary. Want to split profits with your cofounder 60/40 because he brings snacks to every work session? Go for it. Prefer creative “operating agreements” that would break your high school math teacher? The LLC gods do not care.

With an S Corp, it’s all about proportions (and not the fun kind, like milk to cereal ratios). Profit, loss, everything must be split according to actual shares as if the IRS is the world’s pettiest group project teacher.

- LLC = your startup, your rules, your probable tax confusion.

- S Corp = startup, but with lots of board meetings where you bravely ignore Slack pings from your own mom.

Choose wisely, or just pick whichever one looks better in your Twitter bio honestly, that’s what most people do.

But Which One Do Investors Like? (Or: How To Sound Smart at Networking Events)

The dirty little secret? Your uncle’s angel investor advice is from 2006. Most VCs want a C Corp eventually (not in today’s syllabus, sorry), but LLCs can get you rolling fast and cheap. S Corps with their weird ownership rules, can make raising money awkward.

- LLC : adaptability. Start easy, switch when you somehow raise $5M by ideating on Clubhouse.

- S Corps: better for small, local, closely held startups who want the illusion of being a Real Corporation.

Will this matter if your business collapses before IPO? Not at all. But hey, you’ll look SO official at startup mixers!

Let’s Get (Un)Serious: The Clickbait List of What Not To Do

- Don’t pick an S Corp if all your BFFs live abroad the IRS says “nope.”

- Don’t choose LLC if you download TurboTax and hope for the best every year. (You will suffer.)

- Don’t let your VC-cosplay friend scare you: most businesses start as LLCs, get bored, then switch later.

Yes, you can always convert your LLC to C Corp or S Corp later, once your side hustle actually exists outside your Instagram bio.

So, Which Should I Pick?! (Like I’m Actually Going To Tell You)

If you live for rules, Gamma spreadsheets, and want to pay yourself in a tax optimized way go S Corp. If you like chaos, flexibility, and being your own boss (in athleisure), go LLC. If you want to impress your LinkedIn connections, call yourself Founder & CEO and just don’t say how many board meetings you ran in your kitchen.

You are a startup founder now. No matter what you pick you will fill out paperwork, meet with someone called a tax professional and drink enough coffee to regret every life choice.

Final Thoughts (Or, Why Are You Still Reading?)

Look, LLC or S Corp, you’re bound to mess up something (or everything). Just file something before your mom asks about your real job again. If you make it big, remember who explained this to you with the least patience and the most honesty. If not? At least you didn’t spend a year on legal Zoom calls before launching your Etsy for ironic phone cases. See you at the next IRS panic attack LLC , out!