Welcome Hero: You Woke Up and Chose Bureaucracy

So, you want to open a gaming arcade huh? Dreaming of neon lights 8 bit soundtracks and that new-machine smell (it’s plastic hope Cheetos dust)? But before you start counting quarters and debating if Dance Dance Revolution should have its own wing there’s the Tax ID process a.k.a. America’s way of making sure you’re ready to achieve your most adulting moment yet: talking to the IRS.

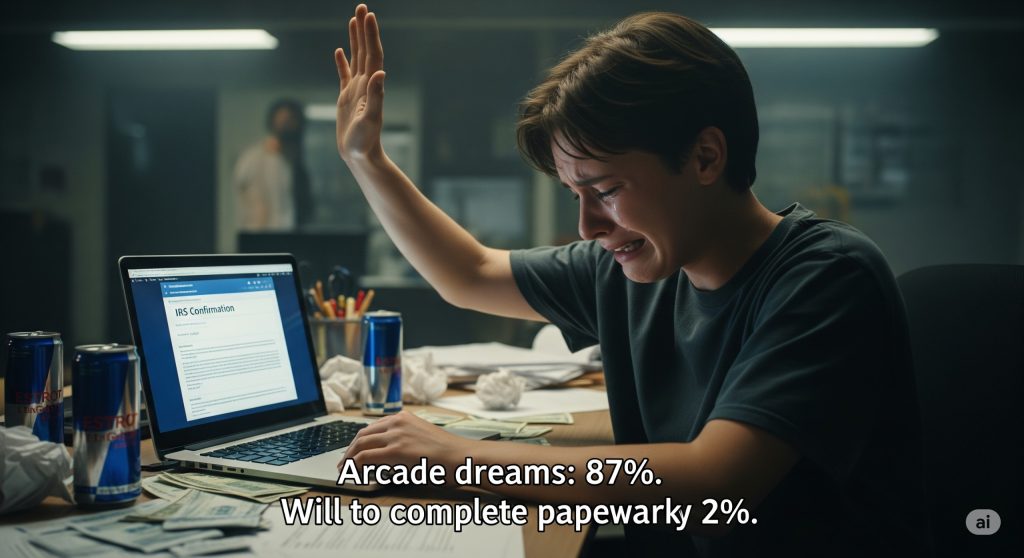

You probably thought the hardest boss was the last level of Cuphead. But that’s adorable. The real final boss is the government website at 2:30 a.m. with a coffee in one hand and your hopes in the other (slowly slipping). Buckle up, player one.

Wait, What’s a Tax ID? And Why Are You Yelling?

Because someone needs to be just as freaked out as you are, okay?! A Tax ID (technically, an Employer Identification Number or EIN) is your business’s social security number except it doesn’t get awkward texts from its ex. The IRS loves it banks require it and it’s the universal badge of I’m legit please don’t audit me.

Translation:

Have a business? Need a bank account? Want employees who aren’t named Uncle Steve working for vintage Pokémon cards? You need a Tax ID. Period. No take sies back sies.

- It’s like making a LinkedIn for your arcade, but the IRS is your only follower.

- You must have a Tax ID if you plan on paying employees opening an actual biz account or surviving a tax season.

- Are you a side hustle for now type? Guess what the moment money enters the chat so does the IRS.

Level 1: Surviving the IRS Website (Boss Music Intensifies)

Ready for a side quest you didn’t ask for? The Tax ID application is mostly online (because you know it’s not 1972) and it’s totally free unless you count the cost to your soul.

Tax ID Process Walkthrough (Yes, You Need a Walkthrough):

- Go to the IRS EIN Application Portal (it’s real not a phishing link, no matter how sketchy it looks).

- Reminder: Only use .gov sites. Scammers are more annoying than lag on Wi Fi night.

- Choose your business type.

LLC? S corp? Mega Arcade Decepticon?

Don’t overthink it, but do try to know what you picked when someone asks. - Type in your info.

- Business address (your apartment over the pizza shop counts only if customers can actually come in).

- Legal name (sadly, Insert Coin Industries is probably taken).

- Answer bizarre questions.

- Why do you need an EIN?

Because the IRS told me to, Karen.

- Why do you need an EIN?

- Smash Submit. If luck’s on your side you’ll get your Tax ID instantly. If not you’ll experience true agony: waiting four whole weeks (if you’re mailing or faxing forms like it’s 1999).

Pro Tip: Don’t refresh the page. The portal is held together by hope and duct tape.

Pop Quiz! Who Actually Needs a Tax ID? (Spoiler: It’s You Nerd)

You might be thinking: I can just use my Social Security Number right? I mean, they’re basically the same ?

Wrong. Very wrong. Like thought you could beat Elden Ring on your first try wrong.

You Need a Tax ID If:

- Your business has employees (even if it’s your cousin paid in pizza).

- You want to open a business bank account without being side eyed by the teller.

- You’re operating as an LLC, corporation or partnership not a solo napper.

- Literally any legit business reason. My dog runs the arcade is not one.

If you don’t have a Tax ID, your business is basically on easy mode until the IRS switches you to hardcore Ironman with permadeath.

Watching Paint Dry: Alternative Tax ID Application Methods

Online not working? (Shocking.) Here’s a speed run of other ways to get that magical number:

Mail: Fill out Form SS 4 (get ready for nostalgia paper cuts) then mail it to the IRS. Wait four weeks.

Fax: Yes, fax. Like Grandpa did in 92. Slightly faster if you locate a fax machine outside a museum.

Phone: Only for folks outside the U.S. or if you love suffering.

Carrier Pigeon: (Just kidding. Or are we?)

Look, if you’re still mailing things in 2025, consider opening a Pony Express themed gaming lounge because that is vintage.

Tax ID FAQs: Because You’re Definitely Overthinking This

Q: Is this process free or what’s the scam?

It’s free. If someone tries charging you, throw a red shell at them. Only the IRS demands your tears, not your cash.

Q: What do I do if I lose my Tax ID?

Call the IRS Business & Specialty Tax Line at 800 829 4933. Be ready to verify you’re not a bot or a raccoon in a human suit.

Q: Does ANYONE care about my tax ID?

Banks, payroll companies, insurers, possibly that one person at parties who always asks unsolicited business advice.

Q: How many times do I have to give out my Tax ID?

Get ready to repeat it as much as your Wi Fi password to every just one Smash Bros game guest.

Let’s Talk Real Perks If You Can Call Them That

Not convinced? Let’s break down why you’ll actually (maybe?) sleep better at night after you finally get this done:

- Legit business status. I have a Tax ID is the new I’ve opened for a band you’ve never heard of.

- Less IRS anxiety. (But never zero. Sorry.)

- Business y doors open:

- Hire actual employees.

- Score business credit cards and loans.

- File taxes like a functioning member of society or at least try.

- Power move:

Frame your IRS EIN letter above the Donkey Kong machine.

Conclusion: You Deserve a Medal (or at Least a Break)

Congrats, you’ve survived more than just the boss fights welcome to adulthood with a joystick. If you followed the Tax ID process, you’re not just a new arcade owner. You’re a paperwork monster, a bureaucracy slayer and (probably) someone who will never look at .gov sites the same way again.

Now get out there and make gaming great again. Or buy another energy drink and stare at your new Tax ID for a few hours in stunned silence. Both are valid life choices.