Welcome, exhausted entrepreneur, panic-preneur, and every Starbucks-fueled hustler whose therapist keeps saying set boundaries. If the thought of starting a business solo makes you need a nap (or another iced latte), congrats this guide is about multi member LLCs, also known as the only way to tie your toxic bestie or your foodie sibling to your side hustle permanently and legally in 2025. Get ready for real talk, less than regal legal wisdom and only slightly more structure than your TikTok algorithm. No chill. All sarcasm. Vibes optional.

1. Limited Liability Protection: Welcome to Safety, Sort Of

Bold move going into business with other people. But a multi member LLC yes, LLC number one) means everyone’s personal assets are protected when things get sufficiently messy. You know, like if your artisanal soap explodes in a client’s bathroom or your food truck fries up the town’s Wi Fi with its smart fryer.

- Your Honda Civic, rent money and that drawer of regrettable concert tees? Safe.

- Sued for copyright on your Vegan Bacon Donut? The LLC takes the hit, not your Netflix budget.

- Unless you do something criminal, then congrats, you played yourself.

If you trust your partners more than Subway’s tuna, this is the closest thing to business safety in 2025.

2. Tax Flexibility: The Only Drama You (Kind) Want

Since multi member LLCs are automatically taxed as partnerships (thanks IRS, love the chaos) your business profits don’t get hit twice. Instead, everyone gets a fancy Schedule K 1 basically the new zodiac rising sign for grown ups with LLC energy.

- No evil corporate double taxation like the olden days. Profits flow straight to your returns.

- You can choose partnership, S Corp, even C Corp taxation, if you think your Excel spreadsheet will ever ever balance.

- Flexibility means choosing how income plays out tax wise: optimize, minimize or just cry as a group. It’s called tax planning, but let’s be real it’s mostly caffeine and prayer.

TurboTax Pro Tip: If everyone’s still googling What is Form 1065?, add a CPA to your group chat.

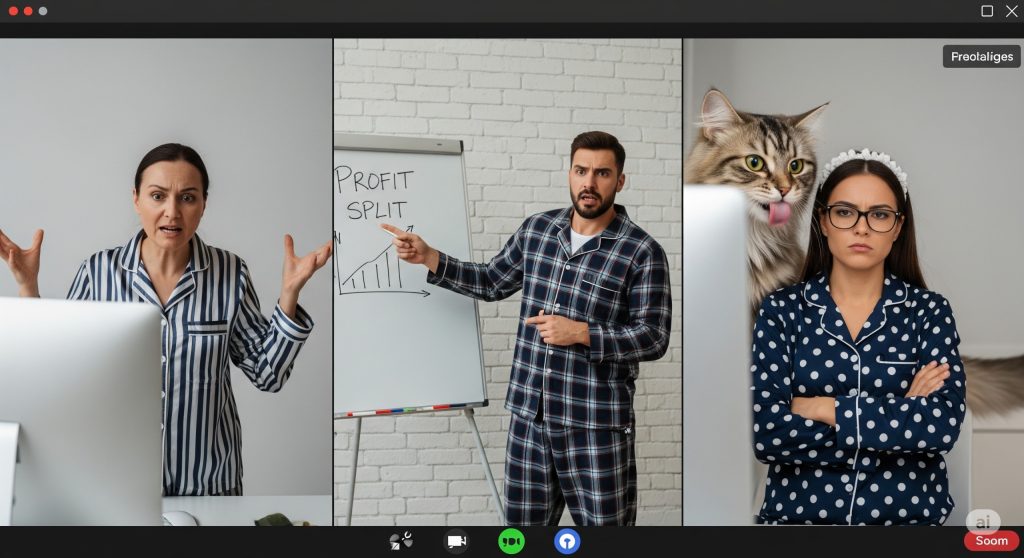

3. Shared Management, Shared Madness: Group Project Trauma, But Profitable

Do you enjoy democracy, chaos and constant circle back emails? Multi member LLCs serve up shared management and profit allocation with all the drama of a Netflix original.

- Split decisions! Debate office snacks, TikTok marketing or which person forgot to file the state fee (the answer: everyone).

- Choose member managed (everyone’s hands in the pot) or manager managed (one person gets all the angry texts).

- Customizable operating agreements mean you can allocate profits based on whatever convoluted formula you agree on equity, effort, or whoever’s cat gets more Instagram likes.

For control freaks: yes, you can write a 40 page operating agreement. For everyone else: coffee, group text, cross your fingers.

4. Pooling Resources: Finally, Your Broke Friends Are Useful

Why go broke alone when you can go broke together? The glory of multi member LLCs is combining capital, skills, networks and questionable ideas.

- Your coder friend brings technical know-how, your influencer cousin brings twenty six ring lights and your neighbor brings a surprisingly honest credit score.

- Pooling funds creates actual financial muscle, so your start up phase might not just be endless ramen and free trial abuse.

- Spread the risk, share the pain and every member can bring something less embarrassing than “ideas.”

Seriously: If you want to scale fast, compete hard or just not go bankrupt for once, group business is the move. LLC here means sharing both the wins and the tax deduction for therapy expenses.

5. Enhanced Credibility and Real Adult Vibes

Let’s not pretend showing up as a multi member LLC on LinkedIn gives you instant Not Just a Hobby status. Creditors, clients and even your mom finally answer the phone.

- Banks are slightly more likely to open a business account based on your LLC . Still, maybe wear clean shoes.

- Potential investors and clients expect formal structure. Our LLC is legally binding! > We pinky swore at Starbucks!

- Enhanced credibility means your side hustle might actually score supplier deals, grants or gasp real press.

Just make sure your website doesn’t look like a Tumblr page from 2013. You want credible not cringe.

6. Succession Planning and Survival Beyond the Next Meme Trend

Did someone get bored? Move to Bali for remote yoga? Decide to start a pickle company instead? Multi member LLCs have built in escape routes. When a member leaves the operating agreement written after three Red Bulls and three emotional breakdowns tells everyone what happens next.

- Smooth transitions, so your business and its LLC survives more than just one viral trend.

- Unlike solo LLCs, continuity is baked in. The show goes on, even if the star quits.

Reminder: If your business goes big, succession planning is less who babysits your dog and more who signs the checks.

Conclusion: Still Reading? You Can Legally Call Yourself a Partner Now

Yes, you made it to the end. Either you really care about your financial future or you just love sarcasm with a side of brutal honesty. Multi member LLCs are the most human friendly way to adult with friends, spread chaos, avoid lawsuits mostly and finally explain your group chats to the IRS.

So, go forth, team up draft that passive aggressive operating agreement, and get ready to enjoy all the benefits of shared liability, shared profits, and naturally shared misery. Because in 2025 the only thing more American than hustle culture is hustling together.