Welcome to the Existential Crisis: LLC or Sole Proprietorship?

Ah, so you woke up today and decided, I’m gonna start a business and definitely won’t cry about taxes, legal fees, or crippling debt! Congratulations, entrepreneur your 3am Google search has led you to the1 debate no one asked for, but everyone needs: LLC or sole proprietorship? Strap in, sip that suspiciously strong coffee and ignore your mom’s Facebook messages about getting a real job. Because making the classic LLC Formation decision is where dreams collide with reality like TikTok trends with your dad’s LinkedIn page. Let’s pick your tax fate with absolutely zero chill.

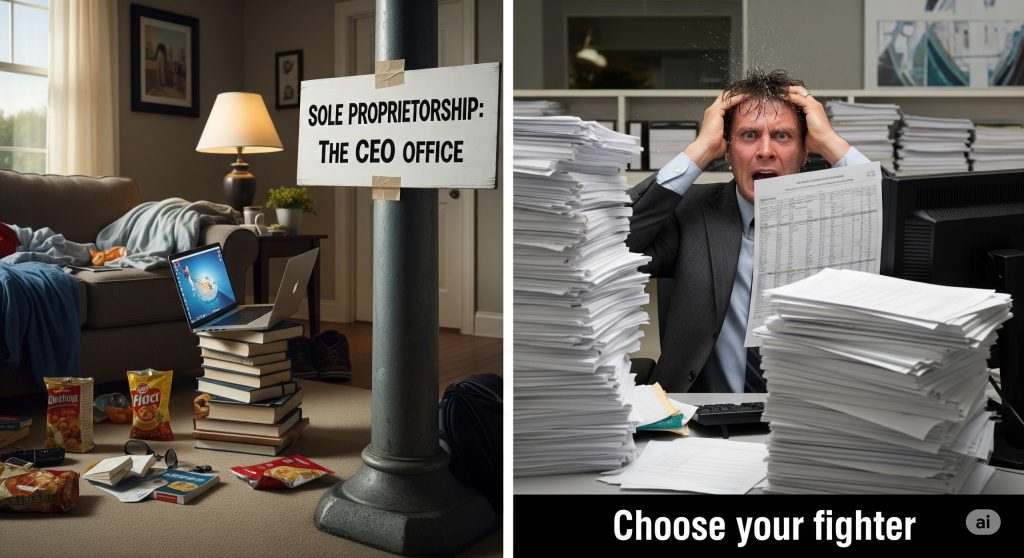

H2: Sole Proprietorship AKA You Yourself and Your Cat (Who’s Also on Payroll)

Bold truth time: Sole proprietorship is the business structure equivalent of flipping your sofa cushions and declaring, Yep this is my office now. It’s all you. You’re the boss the intern the unpaid marketing manager and let’s be real probably the barista.

What’s spicy:

- You get all the coin. No splitting profits. (Unless you count your cat’s emotional support invoice.)

- Tax time is wild. Your business and personal dough get tossed in one blender. The IRS: Y’all ready for this?

- If Karen sues you because your homemade kombucha gave her a stomach ache guess who’s paying? That’s right, you and your PlayStation collection.

It’s like freelance life, but with more existential dread and fewer free snacks.

Would a TikTok side hustle benefit from a sole proprietorship? Sure, if your business is literally selling irony. If you’re aiming to channel your inner Starbucks CEO, keep scrolling.

H2: LLC Look at You, Fancy Legal Structure with Commitment Issues

Oh, so you want an LLC Formation, eh? Plot twist: This isn’t just a bougie acronym for I’m legit, please swipe up! Forming an LLC for your new business means legally your company is its own entity. It’s like having your own reality TV show, but for paperwork.

Why it slaps:

- LLC means your stuff isn’t on the line if Karen attacks the business takes the heat.

- You can, in theory, write off your iced lattes as business expenses. Try doing that with a sole proprietorship and let me know how prison food tastes.

- People trust an LLC. It’s like a secret handshake for business bros. Cue the LinkedIn messages about networking opportunities.

But don’t get blinded by the sparkle. LLC : bureaucracy. You will drown in paperwork, state filing fees and possibly an existential crisis about whether your brand needs a killer website, legal counsel and branded mugs.

You want freedom? LLC is a cage built from ambition and IRS form stacks. Blink twice if you need help.

H2: Which Is Better for Your Business That Will Probably End Up as a TikTok Sketch?

Let’s get delusionaler “analytical.”

Ask yourself:

- Do you want your personal Netflix account seized if things go south?

- Are you cool with government paperwork that reads like a Shrek meme?

- How much do you hate money on a scale from Venmo drama to student loans?

LLC Formation suits those who expect explosive growth, lawsuits or want to flex corporate swag. Sole proprietorship is pure chaos energy: low cost low hassle high risk. (Like every dating app bio but for taxes.)

If you’ve got actual assets or dream of hiring employees who aren’t just your roommate bribed with Door Dash, LLC it up. If you just want to sell ironic slogan tees sole prop is king. LLC flexibility. She’s kind expensive kind complicated kind worth it if you’re not living in your mom’s basement.

H2: Let’s Compare, Because Lists Are Clickable and My Attention Span Is Shot

Sole Proprietorship Pros:

- Dirt cheap. Netflix tier commitment.

- E Z taxes. It’s all one sad stack.

- No paperwork. You hate plans anyway.

Sole Proprietorship Cons:

- Your stuff fair game for creditors. Nice PS5, champ.

- You’ll look less official than a lemonade stand.

LLC Pros:

- Protect your stuff. That PS5 is safe (for now).

- Legitimacy: business world takes you seriouslyish.

- Flexible taxes: you even get to pick your IRS mood.

LLC Cons:

- Fees, paperwork filings it’s a vibe just not a good one.

- The annual did you pay your LLC tax? panic.

LLC: asset protection. That’s right LLC protects not just your dignity but your precious collectibles.

LLC Formation or Wild West Hustle? The Conclusion You Didn’t Ask For

And there you have it. A guide so unhelpfully honest you’ll need to lie down. Whether you pick the LLC path to legit biz glory or the sole proprietorship chaos, just remember: everyone’s winging it, and the IRS sees all. LLC Additional Keyword: brink of adulthood.

Good luck, future mogul don’t forget to Venmo me if you strike it rich (or need bail money after your kombucha startup implodes). You made it to the end so either you’re in deep Google rabbit hole territory or just really love pain. Admit it: you’re still not sure and it’s iconic. Go start your empire. Or at least a meme account.