Welcome, Founder: Now Prepare for Structure Regret

So you want to start a startup. Adorable. You’ve binge watched Shark Tank, own two ironic mugs and your group chat is already judging you. It’s time for the hottest question no one wants to answer: do you go LLC or C Corp? You’re just here for LLC but congratulations you just unlocked tax code, legal drama and at least three new types of anxiety. Pour another $6 Starbucks, and let’s surf this legal hurricane disguised as business formation. Entrepreneurship: always one Google tab away from an existential crisis.

C Corp: For When Your Ambitions Are Longer Than Your Coffee Order

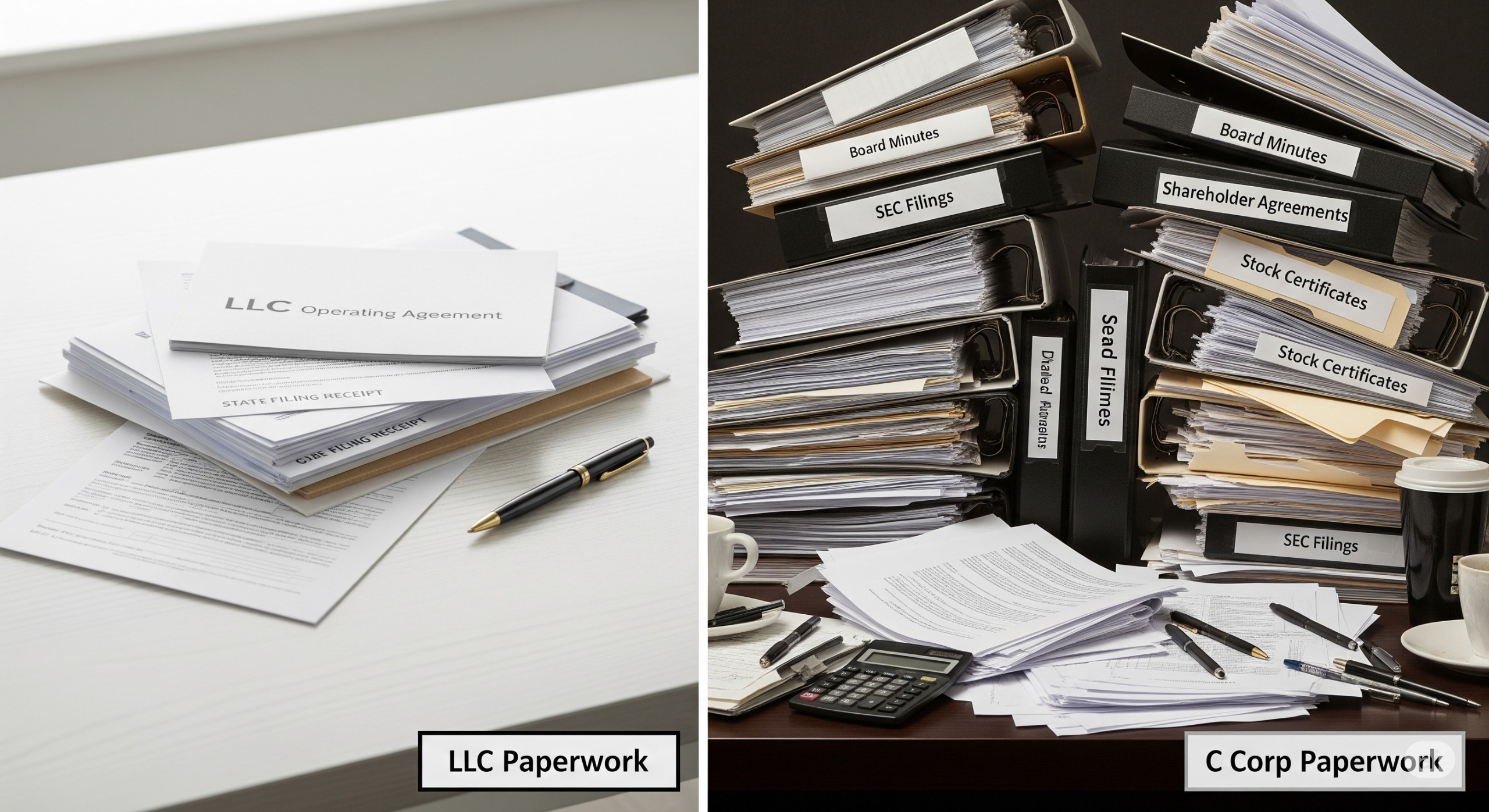

Here’s the scoop: The C Corp is what you pick when you want everyone investors, big tech, maybe your grandma to take you seriously. We’re talking formal shareholders, a board of directors (hi, endless meetings), and paperwork that makes student loans look like a post it note.

- Double taxation? Oh yeah. Pay at the corporate level. Then pay again as a shareholder when you take dividends. It’s capitalism with a side of tax drama.

- Unlimited shareholders. Want your startup to be owned by 3,000 rando and a hedge fund in Luxembourg? Go nuts the C Corp is limitless.

- Venture capital magnet. Most VCs won’t even reply to your pitch deck unless you’re set up as a Delaware C Corp. If your dream is to sell farm to table oat milk to the masses via IPO this is the ticket.

Downside?

It’s compliance jail. There are board meetings, annual reports, and mysterious minutes you never actually type up. One day you’ll blink and see your soul in a shredder marked IRS Audit. But hey: look at all those snazzy stock options you’ll give future employees before you run out of runway.

LLC: The Chill, Commitment Phobic Business Structure

LLC alert! Think of the LLC as the law’s answer to I just want to vibe no strings attached. No board, no crazy formalities and profits (or losses, let’s not judge) pass right to you so you only get taxed once. Yeah, you can eat your tax break and have it too.

- Pass through taxation. Money skips the corporate taxes and lands straight on your personal return. Simple, right? Until it’s not, but you can always pretend.

- Flexible management. Your squad, your rules. Optimize profit splits, or just panic when someone actually makes a profit.

- Less paperwork. No shareholder meetings no annual chanting by candlelight just you, your laptop and maybe your cat with opinions on equity.

But here’s the not so chill catch:

Venture capitalists look at your LLC and go, Hard pass. They want shares, not your vibey operating agreement. If raise $10M is in your five year plan the LLC vibe will expire fast.

Which Saves Me From Going Broke? (Let’s Do Bad Math Together)

We don’t need a CPA to know: Cash is king, and you’re already budgeting in ramen. So, which structure makes your wallet cry less?

- LLC tax magic: Money flows to your personal return. No double taxation. DIY friendly, until the IRS slides into your DMs.

- C Corp tax hellscape: That legendary double taxation. Profits get hit at the corporate level, then you get taxed again taking anything out as a dividend.

- BUT (plot twist!): C Corps pay corporate tax at 21% sometimes less than you would as a human. And reinvesting profits back into the company? Untouchable by personal tax. Billionaires don’t file as LLC honey.

Bottom line: If you want to operate lean, avoid VC and sleep (alright, nap) at night LLC is your thrift store steal. If you imagine a future with multiple rounds, equity laden hires and a LinkedIn so full your friends think you’ve been hacked, C Corp is your destiny.

Fundraising, FOMO and the Group Chat Test

Will your big idea take you from Etsy crafts to Wall Street bell ringing? Investors want structure specifically, the LLC of the business world: the Delaware C Corp.

- LLCs: Great until you need outside money. Angel investors might cope, but VCs? They’ll ghost you faster than a Tinder match on moving day.

- C Corps: The golden child for issuing shares. Attracts investors, incentivizes employees with stock options and gives you the street cred to DM Let’s connect? to strangers on LinkedIn without shame.

Ask yourself: If your group chat would laugh at annual shareholder meeting with yourself, LLC is probably your lane.

Smart People Choose the Right Structure Right? (Please Laugh Now)

There is no right. Only less wrong, and more expensive. You can always convert an LLC to a C Corp later just prepare your soul (and your wallet). Most startups start laid back as LLCs, join a startup accelerator then C Corp their way to debt and glory. It’s the circle of founder life.

Here’s a quick roast:

- Want to keep your business small, manageable, and cozy? LLC.

- Want to raise capital, hand out stock options and one day ring that IPO bell? C Corp.

- Want to impress your parents at Thanksgiving? Good luck.

Let’s List the Pain Points (Because Lists Ambition)

LLC Advantages:

- One tax return to rule them all.

- Flexibility: profit splits, management, work from anywhere lifestyles.

- Less paperwork, more time for doom scrolling.

C Corp Advantages:

- Sky’s the limit for shareholders.

- Super attractive to VCs and investors.

- Perpetual existence (your business will outlive your will to hustle).

LLC Disadvantages:

- VCs send your emails to spam.

- More complicated to issue stock, grant options, or play in the big leagues.

C Corp Disadvantages:

- Filing fees, compliance, tax layers like an onion.

- Must love annual paperwork. No one loves annual paperwork.

Final Thoughts (Or: You’re Still Here, Wow)

You read this far? You probably deserve an honorary MBA (or at least a stronger latte). Remember, whether you pick LLC or C Corp your business journey will be messy, meme able and filled with at least one tax panic attack.

If you’re suddenly inspired, tweet this to your cofounder and start the next legal paperwork binge. If you’re more confused congrats you’re truly ready for entrepreneurship. See you at the next board meeting (a.k.a. crying in your car outside of Starbucks).