So You Formed an LLC Now What? It’s Not Just About the Name, Boo

Look, forming your LLC was the easy part sort of. The real flex? Building business credit. Because, surprise, banks and vendors don’t just throw money at your dreamy side hustle. They want proof you’re more than just a caffeine fueled fantasy. Good news: building business credit is mostly about adulting with style more paperwork, fewer existential crises maybe.

Your LLC’s business credit score is basically your brand’s report card in the grown up finance world. Nail it and you unlock loans, better vendor terms, and maybe that sweet business credit card that doesn’t require your personal credit to take the hit. Fail it, and enjoy the awkward dance of rejections and no s.

Buckle up it’s time to turn your LLC into a creditworthy business beast.

Step 1: Form That LLC Like a Legal Legend

Bold statement:

Your LLC is not a brand until it’s a legally separate entity.

This means going full adult:

- File those Articles of Organization. Yes, it’s a thing, not just a mid level boss phrase.

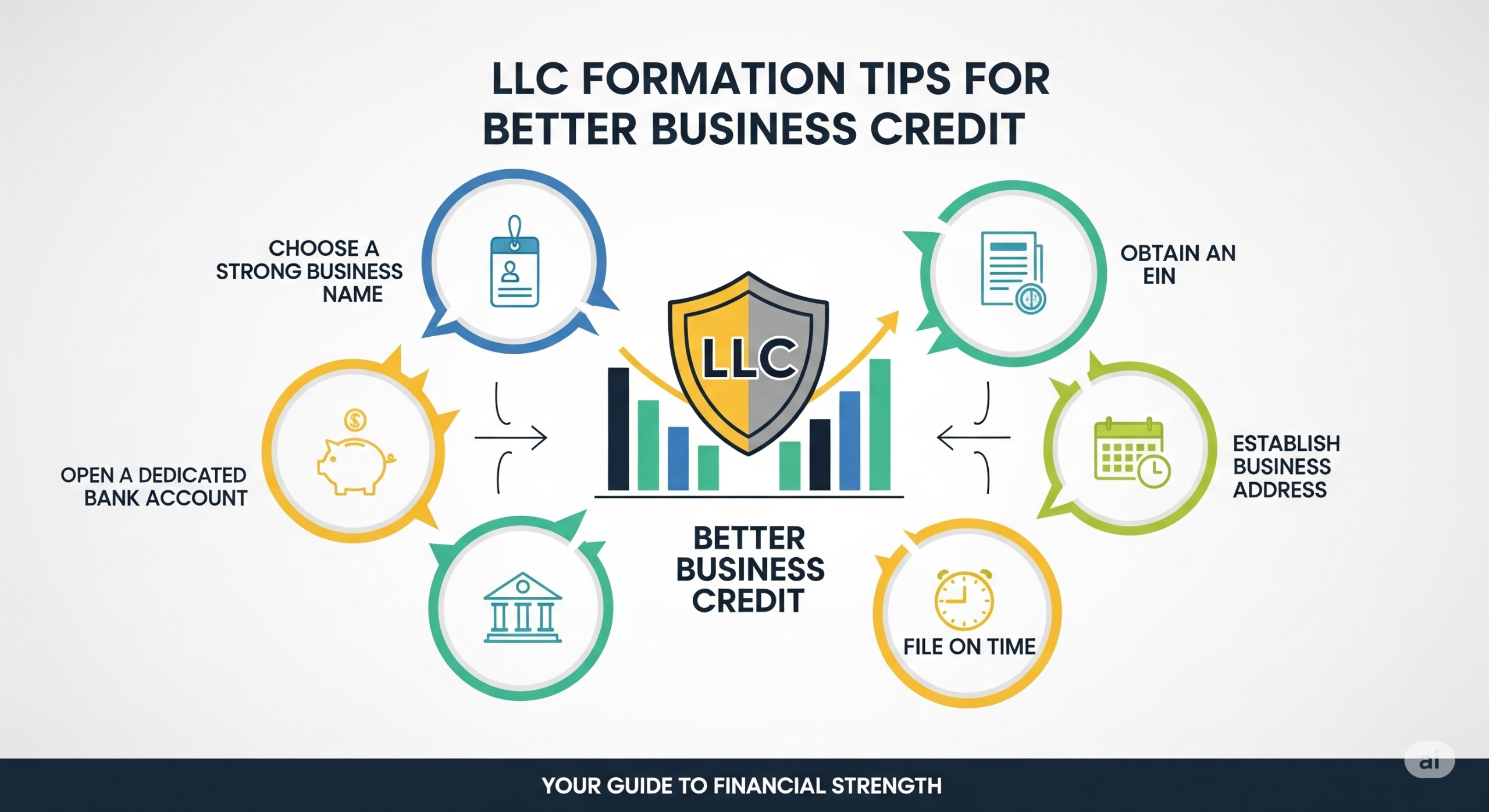

- Obtain your EIN Employer Identification Number from the IRS the business version of a social security number.

- Separate your business and personal finances. Open a dedicated business bank account, or your personal account’s going to look like a confusing soup of lattes Netflix payments, and stealth online shopping.

Pro tip: Don’t even think about mixing the two. You want your LLC to shine as an independent entity, not a freelance project hiding under your bed.

Step 2: Open a Business Bank Account Like a Grown Up Who Actually Plans to Pay Bills

No, Venmo your rent money doesn’t count.

Your business bank account is the VIP club entrance to business credit city. You can’t build credit with cash stashing or mixing business Chai lattes with your dog’s vet bills. Keep it clean:

- Use your LLC legal name everywhere.

- Make all business transactions flow through this account.

- Pay bills, vendors and taxes from here to signal to lenders and credit bureaus you’re serious.

Side note:

Banks love consistency. If your money looks like it’s doing the cha cha between accounts they get suspicious and crank up the risk rating.

Step 3: Get Those Business Credit Cards and Net-30 Accounts Flying (Yes, It’s a Thing)

Your personal credit can take a backseat now, with the LLC stepping up front and center.

- Apply for a business credit card that reports payments to business credit bureaus like Dun & Bradstreet, Experian, and Equifax.

- Start small and build trust: get vendor accounts offering net 30 or net 60 payment terms and make every payment early or on time.

- No, you don’t get credit instantly. But patience is a business virtue pay bills on time, keep credit utilization low and don’t max out your business card on daily avocado toast.

And no, buy 10,000 TikTok followers isn’t a credit building strategy, but thanks for asking.

Step 4: Always Monitor and Manage Your Business Credit Like Your Dog’s Instagram Account

Business credit scores can tank faster than your Wi Fi during a Zoom meet. Stay woke by:

- Regularly checking your LLC credit reports from the major bureaus.

- Disputing errors because Oops! That’s not me signing up for 400 candy subscriptions is a legitimate business excuse.

- Keeping credit utilization below 30% because no one loves a desperate borrower doing digital window shopping.

- Communicating openly with creditors if cash flow gets rocky you’re a human, not a superhero despite what your LinkedIn says.

Bold reminder:

Late payments are the business credit version of ghosting. Avoid it.

Step 5: Separate Your Business and Personal Credit Like You Separate Your Laundry

Mixing personal and LLC business finances is the equivalent of wearing socks with sandals to a client pitch. Just don’t.

- Use only your EIN when applying for business credit products.

- Avoid personal guarantees on business loans unless you like risking your couch.

- Keep personal spending off your business card and vice versa.

- When asked, Is this your personal card or business card? at Starbucks, confidently say Neither and just use Apple Pay.

Trust me, your LLC credit profile will thank you.

Wrap Up: Your LLC Deserves Credit That Doesn’t Cause You to Cry in Boardrooms

Look at you, legit adult! Forming an LLC is the caffeine shot. Building business credit is the buzz that keeps you hyped on growth and opportunity not rejection and bad terms. Your LLC is your business’s creditworthy alter ego, ready to take on investors, lenders and vendors with confidence.

If you got through this without googling how to fake a credit score, congrats you might just make it. Now go forth, build that credit, and boss up like the caffeinated legend you are.

And hey, next time someone asks if your business is real, you can drop We have business credit with a wink. Mic drop.

If you do actually launch and rock this business credit game slide into my DMs for a sarcastic high five. You’ve earned it.