So you’ve been told you need a “business plan with financial projections”—just a simple 60-page novella outlining how you’ll go from “vibes and ambition” to IPO before your student loans enter repayment, right? Maybe you even downloaded that free template, stared at it for three hours, and wondered if you could just submit your TikTok follower count as a cash flow statement. Well, pour another overpriced iced coffee, future mogul, because this is the brutally honest, barely hinged guide to what to actually put in that business plan—especially the finance part, which, let’s face it, is the main event. Oh, and yes—it will require more self-delusion than a LinkedIn “Open to Work” banner.

The Executive Summary: AKA, Your PowerPoint-in-a-Paragraph

Let’s be crystal clear: if your business plan were a Marvel movie, this would be the 90-second trailer. Does anyone care about the rest of your document? Not if you flop here.

What goes in:

- Who are you and what do you sell? (“We’re like Uber, but for pets who hate Uber.”)

- What’s the problem you solve? (“35% of Americans have never had sushi delivered on a drone—until now!”)

- Key numbers: “Market size: $900B. Addressable market: my entire neighborhood. Projected unicorn status: inevitable.”

- The “ask”: How much money, and why? (Polite hint: don’t write, “I just want a new MacBook and rent for six months.”)

Real talk: If your summary makes you question your life choices, you’re on the right track. If it inspires an urge to nap, rewrite it faster than TikTok’s For You Page recycles viral sounds.

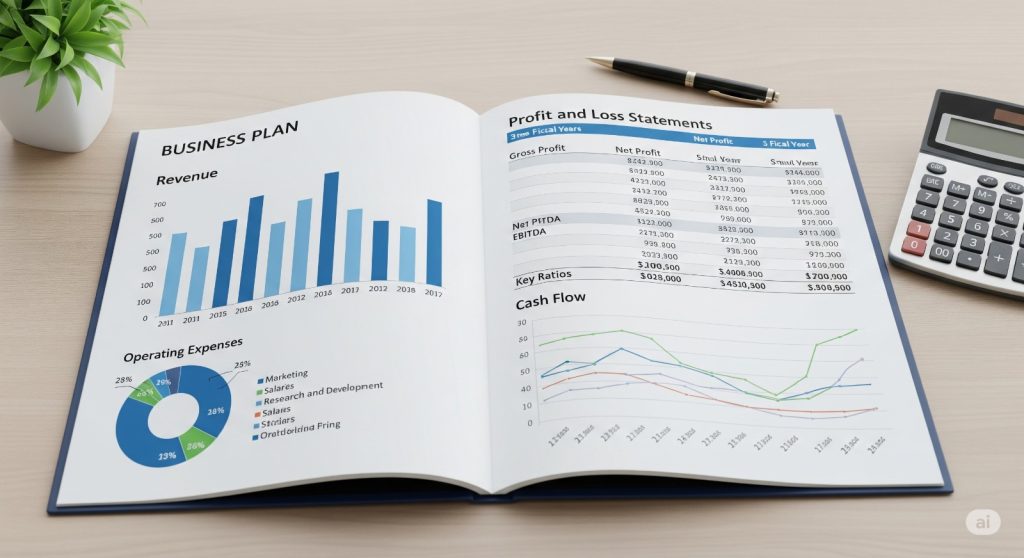

Financial Projections: Where Delusion Becomes an Excel Sheet

Think of this as the part where you convince yourself—and maybe grandma’s financial planner—that your money pit is actually future gold mine. Here’s the essentials for your Business Plan:

Income Statement (Profit & Loss, but Make It Fashion)

- Revenue forecast. How much money will you allegedly make? (Add “viral growth,” sprinkle with “seasonal spike,” and hope nobody checks the math.)

- Cost of goods sold (COGS): “Raw materials: $500. Caffeine: priceless. Sanity: non-renewable.”

- Gross margin: Investors love margins. The bigger, the better. If you can’t justify it, just color-code and move on.

- Operating expenses: Rent, ads, legal fees, that one “consultant” you met at a networking event (aka your cousin Chad).

Cash Flow Statement (How to Pretend the ATM Will Never Eat Your Card)

- Open with: “Starting cash: $0 (because, same).”

- Add in: “Inflows” (investor money, revenue, mysterious “grants”)

- Add outflows: staff, rent, dog-friendly office supplies, therapy.

- End with a number that’s green (or at least, not blood-red) by Year Three.

Balance Sheet (Assets, Liabilities, and Existential Regrets)

- Assets: Inventory, cash (lol), maybe a half-used “Business Growth” book.

- Liabilities: Loans, credit card debt, and emotional damage.

- Equity: Whatever’s left over after you pay taxes, bills, and your roommate for taking the trash out.

Breakeven Analysis (The Pie-in-the-Sky Special)

- At what point will you finally stop losing money faster than it comes in?

- If the answer is “Year 11,” just write “Year 2” and hope for the best. No one will remember anyway!

Market Analysis & “Proof” You’ve Googled Something

Let’s make the financials look less like an artistic expression and more like you’ve “done your research”:

- Target market: “18–35-year-olds who own a phone and breathe air.”

- Industry size: Reference at least one stat from a sketchy marketing blog and one from the SBA to feel balanced.

- Competitors: Name them. Subtly shade them. Claim you’re “unique” because your logo uses millennial pink.

- SWOT Analysis: Just write “Strength: vibes. Weakness: cash. Opportunity: TikTok. Threat: TikTok updates.”

The Team & Operations: Or “How Will This Not Instantly Implode?”

“Best team wins.” —Everyone who won. So flex yours, even if it’s just you, your cat, and a cousin who answers emails sometimes.

- Org chart. It’s fine to lie. “Chief Operating Officer” = your roommate who pays Venmo on time.

- Who does what? (Besides scrolling Instagram at work.)

- Key partners: Name-drop, baby. Shopify, Stripe, “Local boba shop with sick Wi-Fi.”

- Operations plan: Vague logistics that imply you’ll actually deliver on time, and nobody will cry in the stockroom (much).

Fact: The more official your operations schedule looks, the less anyone will notice it’s just a screenshot of Google Calendar color-coded with meme categories.

The Ask: Who, What, How Much, And Why Again?

This is the “Venmo me” text of your Business Plan. Investors want specifics:

- Clearly state how much you want (Money, not “support” or “good vibes”).

- Detailed breakdown of how you’ll burn, I mean, invest every dollar.

- Timeline for cash use (“Q1: pay rent. Q2: design hoodie merch. Q3: survive.”)

- Implied exit plan (“IPO by 2027, or acquired by Amazon, whichever happens first.”)

Tip: If your “use of funds” chart isn’t at least 75% plausible, make it 100% colorful. No one can resist a rainbow pie chart.

The Random (Yet Crucial) Appendix

You thought you could skip this? Fool! This is where you pile every document you don’t know what to do with:

- Legal stuff (the one LLC doc you didn’t lose)

- More charts (never enough)

- Beta user testimonials (aka, your mom’s rave review)

- That “advisory board” resume from someone you briefly met in college

Relax—no one reads the appendix, but if you skip it, there’s a 95% chance someone will complain.

The Grand Finale (Because Life Is Short and Podcasts Are Long)

And there you have it—every tragicomic, caffeine-fortified detail you need for a bank-ready (or, at least, meme-ready) business plan and legit-looking financial projections. Did you learn what to include? If you even read this far, you now know:

- Where to place the numbers (anywhere, just make them go up),

- What to say about your “team” (be bold with the bios, shifty with the actual workload),

- And why pie charts are the real MVP.

If you actually finish your business plan and manage not to drop your laptop out the window, you’ve already outperformed half of LinkedIn. Now delete the word “synergy,” update those projections every time you get a new idea, and start planning your victory speech for when a VC finally laughs at your cat meme and writes a check.

And remember—when in doubt, just copy/paste your best Excel chart and pray. Investors can smell fear, but not a creative margin.