Intro: Welcome to the World of LLC Russian Dolls

So you started an LLC. (Congrats! Did you get a trophy, or just a migraine?) Now you’re wondering: can you stack businesses like Tupperware and have your oh so glamorous LLC own another LLC in the U.S.? Maybe you’re channeling your inner mogul or maybe you’re trying to impress your finance bro roommate who only speaks in words like synergy and vertical integration. Either way, buckle up: this is the LLC formation rollercoaster. There’s legal jargon, pop culture references, and if you survive until the end enough knowledge to out snark your cousin at Thanksgiving.

LLC Inception: Like Inception, But More Paperwork and Less DiCaprio

So, can an LLC own another LLC? Uh, YES. Forget the TikTok lawyers actual grown up law agrees. Your LLC can go full Matryoshka doll and own another LLC, and the government is shockingly chill about it.

Why would you do this?

- For maximum drama (and liability protection, if we must be boring).

- To separate “Big Biz, LLC” from Side Hustle, LLC. (Did someone say tax season is coming?)

- Because Americans treat LLC formation like their unmatched Starbucks rewards collect them all!

Side comment: If Leonardo DiCaprio started a holding company for his Oscars, he’d make each one a separate LLC. Then he’d only lose one award at a time.

The Parent Trap: LLC Edition, Featuring All Your Abandoned Side Projects

You dreamed of building an empire, but your LLC is still just a baby. What happens when an LLC owns another LLC in practice?

- “Parent” LLC owns “Child” LLC just like your collection of half forgotten domain names.

- It’s called a parent subsidiary structure and it’s legal, popular and very much office drama waiting to happen.

LLC formation :

Don’t forget to file those Articles of Organization. It makes your business look way more legit than that “business card” you printed on your roommate’s inkjet.

So yes, your LLC can own 1%, 50%, or the whole pizza pie (100%) of another LLC no crust left behind.

Pop quiz: Is this for billionaires only? Nah, works for you, your gym buddy who sells vitamins, and every aspiring Etsy tycoon.

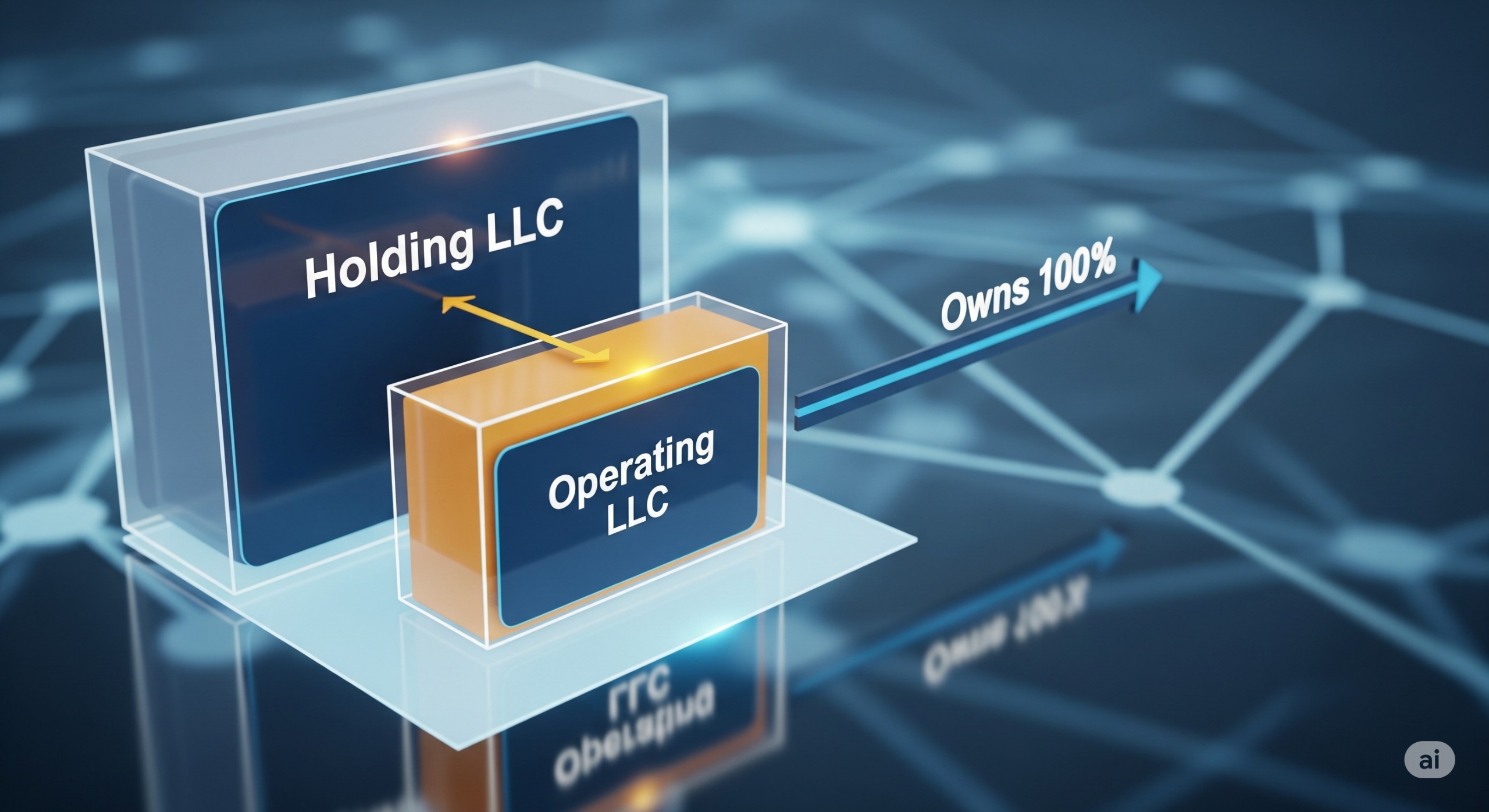

Holding Company Flex: When Your LLC Is Just There to Judge

Some savvy CEOs create an LLC whose only business is owning other LLCs. That’s a holding company and it’s sophisticated AF.

Why go full holding company boss?

- Segregate assets like your playlist from your ex.

- If your Side Gig LLC tanks faster than a reality show the main holding company doesn’t go down with it.

- It feels fancy. Admit it.

LLC formation :

If your LLC decides to go all mob boss, ask yourself: Do I need to protect my assets from angry customers, wild market swings, or just my own bad decisions? If yes, holding company time.

Series LLC: Because One Umbrella Is Never Enough in This Rainstorm

Want to get even wilder? Some states (looking at you, Delaware always extra) allow Series LLCs. You form one “umbrella” LLC, and it spawns multiple baby LLCs inside each with its own personality, liability and ability to ruin a dinner party debate.

- Less paperwork. More existential confusion.

- Each series has its own assets (your crypto stash goes here, vintage sneakers go there).

- Not every state’s cool with this sorry, New York, you’re still basic.

Side comment: “I run a Series LLC!” is millennial for “I own a plant, a dog and a side hustle named Greg.”

LLC formation :

Make sure your umbrella LLC’s operating agreement is stronger than your willpower during the last hour of a Zoom meeting.

“Why Bother, Bro?” Here’s Why LLC on LLC Ownership Might Save Your Fanny

It’s 4:37a.m. you’re still awake, plotting your LLC empire, and wondering if any of this is worth it. Actual pros:

- LIABILITY PROTECTION (so your candle company’s lawsuits don’t sink your dog-walking brand).

- Tax efficiency. Pass through taxation. That means the IRS gets less of your TikTok check than your landlord does.

- Better asset management (no more losing fifty bucks in spare change because you can’t remember which LLC paid for lunch).

Cons? You guessed it:

- More paperwork than a college group project.

- Separate expenses for each LLC your Starbucks budget may need a board meeting.

- Explaining it all to your parents. Good luck!

If your heart yearns for chaos, LLCs are the business structure for you. If not have you considered early retirement?

The Real Talk: Exactly How to Stack LLCs Without Losing Your Sanity

Suppose you’re genuinely trying to do this, not just flex on LinkedIn. Actual steps:

- Form your first LLC. (The LLC formation is your business BFF.)

- Create your subsidiary LLC(s). Yes, you need NEW, separate filings.

- Write operating agreements. Because lawsuits over Taco Tuesday profits aren’t fun.

- Register tax IDs for everyone. IRS loves paperwork give them what they want.

- Consult your very own over caffeinated lawyer. They’ll love explaining LLC formation five times in a row.

Side comment: Can I just call both LLCs ‘Greg’ and be done? Nope. You’ll regret that the minute you get a business email addressed Dear Greg LLC Greg LLC

Conclusion: Your LLC Is Ready for World Domination (or Just Local Chaos)

You made it! You now know that, yes an LLC can own another LLC in the U.S., legally, proudly, and with more paperwork than your college applications. So go forth, start your LLC formation journey, and build that mighty empire (or mildly annoying business web). Tell your friends, confuse your relatives, and remember every great founder started with one LLC and immediately wanted five more. Now go buy yourself a venti. You’ve earned it or your holding company has, anyway.

Because let’s face it: Nothing screams “success” in 2025 like having LLCs inside LLCs, purely for the receipt drama.