Welcome to Freelancing in 2025: Where Everyone Has a Side Hustle and Existential Dread

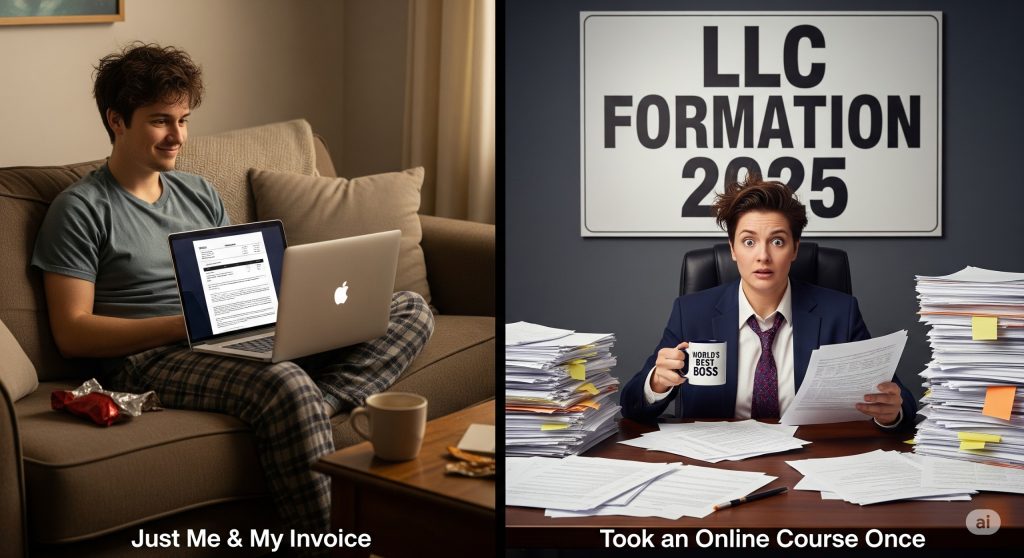

So you want the digital nomad life writing blog posts from a coffee shop, designing logos in your PJs or let’s be real, answering endless Slack pings in a kitchen with a dying poth. But then the adulting hammer drops: Should I start an LLC for my freelance work? Suddenly you’re not just dodging client calls you’re dodging legal drama, tax pitfalls, and your aunt’s questions about getting a real job.

Let me guess: you’d rather watch Tik Toks about ‘work hacks’ than file paperwork but here you are, searching. I salute your caffeinated curiosity (and impressive ability to multitask between 14 browser tabs).

LLCs: The Glow up for Your Freelance Side Hustle Or Just a Fancy Sticker?

Let’s get this out of the way: Nope, an LLC isn’t legally required to freelance in the U.S. in 2025. You can be a proud sole proprietor, reporting your earnings directly to the IRS on your personal tax return, just like a true free spirit.

But here’s the kicker an LLC is like the verified blue check for freelancers. That shiny layer of liability protection? It’s real. If a client hates your work and sues, your Peloton, PS5 and highly-curated vinyl collection are safe probably. Forming an LLC means your personal and business assets are technically separate, so your I pay rent for this? apartment isn’t on the line if Karen from Accounting demands a refund.

Is it glamorous? Nope. Will your banker respect you more? Also nope. But sometimes the legal buffer is worth it when Dollar General says they only pay LLCs, or you finally land that Fortune 500 client.

Show Me the Money: Will an LLC Make You Rich (Or At Least Less Broke)?

Time for brutal honesty: Forming an LLC won’t magically land you bigger gigs, but it might stop you losing your Nintendo Switch in a lawsuit.

The most hyped perks?

- Asset and liability protection. Because nothing says adulting like hiding your stuff from creditors and angry clients.

- Tax flexibility. LLCs can be taxed like sole proprietors, partnerships, or even S Corps, depending on your commitment to paperwork hell.

- Business bank accounts and credit. Separate your grocery runs from business expenses (no, coffee isn’t always deductible).

- Professional glow. Some clients take you way more seriously if your legal business name doesn’t end with Venmo me, please.

But be warned, hopeful influencer:

LLCs mean annual filing fees, more taxes to consider, and an urgent need to keep your business and personal Venmo accounts separate. Mess up your records and the IRS will show up like your landlord checking for pets.

Wait, What If I Just Don’t? (AKA, The Sole Prop Saga)

A shocking confession: most freelancers in 2025 still roll as sole proprietors. Why? Because no paperwork + instant start more time for dog Tik Toks and less time crying over IRS forms.

Pros:

- Dirt cheap: $0 startup cost, unless you want a D.B.A. (Doing Business As) name for your personal brand.

- DIY tax time: You and your business are the same fill out one return, then stress eat pasta.

- No annual filings (beyond your regular self employment taxes which you definitely remember to pay quarterly right?).

Cons:

- Zero legal protection: If you get sued so does your savings account. Oops.

- Business credit is a myth: Forget that business Amex no LLC, no dice.

- Total chaos: Mixing personal and business is a fast pass to stress, audits and confusion when it’s time to write off your office supplies.

If you’re still invoicing from a Gmail address and listing every task as miscellaneous, a sole prop might be your aesthetic. For now.

But All My Freelance Friends Have LLCs! Am I Doomed?

Don’t let LinkedIn fool you: starting an LLC isn’t the Ariana Grande ponytail of freelancing (trendy, slightly intimidating, totally unnecessary maybe).

Here’s when you’ll REALLY want an LLC:

- Your freelance biz is more than side money it pays your rent, therapy and oat milk addiction.

- Clients require contracts with a real business, not AshleyMakesLogosAndTriesHerBest@gmail.com.

- You want to hire people. (Or at least threaten to.)

- You’re tired of having your personal Venmo exposed to nosy clients or the IRS.

On the flip side, keep it simple if:

- Your freelance hustle is more beer money than paychecks.

- You only work with small clients unlikely to sue you (shoutout to Sarah H. from Instagram!)

- The sight of government paperwork makes you itch.

- You’d rather die than pay an annual state registration fee to feel official.

LLC might be the move when you care about protecting what you have or playing pretend with the big kids. Just know: you’ll still have to do taxes, invoices and yes client chasing. Some things never change, LLC or not.

Okay, but What’s the TLDR? (You’re Welcome.)

Don’t want to scroll? Fine. Read this, feel validated, move on:

- No, you don’t need an LLC to freelance in 2025.

- If you want max chill be a sole proprietor and cross your fingers.

- If you want asset protection, business bank accounts more contracts or dream of being on someone’s preferred vendor list, get an LLC.

- Tax benefits are real but so are fees and extra paperwork. Don’t cry (yet).

Seriously, most freelancers start solo and add the LLC vibe when the gigs get real or when their therapist suggests it. Your career, your chaos.

The Real Bottom Line (Because Clickbait Lists Give No Closure)

Look: the LLC question is just 2025’s version of Do I need a ring light to take video calls? Sure, it helps, but it’s not a law of nature.

Start as a sole prop if you want. Level up to LLC if you feel spicy, love paperwork or genuinely fear being sued by someone named Karen.

Either way your freelance life will feature taxes, endless client emails and a strong chance your mom will never get what you actually do.