Welcome to the American Dream, 2025 edition: where you need a Business Plan longer than the Terms of Service you definitely didn’t read, just to beg a bank for money you’ll almost immediately spend on inventory, rent, and—let’s be honest—several “I’m a Founder” lattes. Yes, you’ve officially reached the “please approve my loan” stage of adulthood. But don’t worry, you’re not alone. Banks have made it so delightfully complicated that every hopeful entrepreneur must write what’s essentially a love letter to Number Crunchers Anonymous. Let’s walk through this bureaucrat’s fever dream together—with sass, caffeine, and enough U.S.-centric sarcasm to leave your loan officer wondering if you write for Netflix.

Executive Summary: Where Banks Decide Your Fate (While Pretending They’ll Read Further)

First up: the executive summary—the Tinder profile of your Business Plan. Spoiler: if you don’t wow them in the first page, your application gets ghosted harder than your last Hinge match.

Things your “summary” absolutely MUST include:

- Who are you, other than someone who owns three branded mugs but no actual business yet?

- What does your business do (in non-cryptic language, please)?

- Why this idea now? (No, “it came to me in a dream” is not a bankable strategy.)

- How much money do you want, and how will you allegedly pay it back?

- Undercaffeinated optimism, formatted in Calibri because Times New Roman says “I peaked in 2006.”

Pro tip: The more you try to sound like you don’t desperately need this money, the more desperate you sound. It’s an art form

Company Description: Sell It Like You’re on Shark Tank (Except More Boring)

Banks, tragically, are not charmed by your elevator pitch. They want dry facts, not “founder’s origin story”—so save the Tony Robbins stuff for TikTok.

Checklist for this section:

- Actual company name (bonus points if it doesn’t contain random numbers or the word “synergy”)

- Where you’re registered: No, your mom’s duplex doesn’t count as a “corporate headquarters”

- Legal structure: LLC, Corp, Sole Prop, “currently hoping for a miracle”

- Years in business (even if that year started last Wednesday)

- What, precisely, you’re selling and who you’re selling it to (real customers, not “potential target markets” who exist only in your notes app)

- Mission statement: “Make money (and not panic too much)”—but say it fancier

If you can list every part of your business without giggling, congratulations, you’re already more bank-ready than the average side hustler.

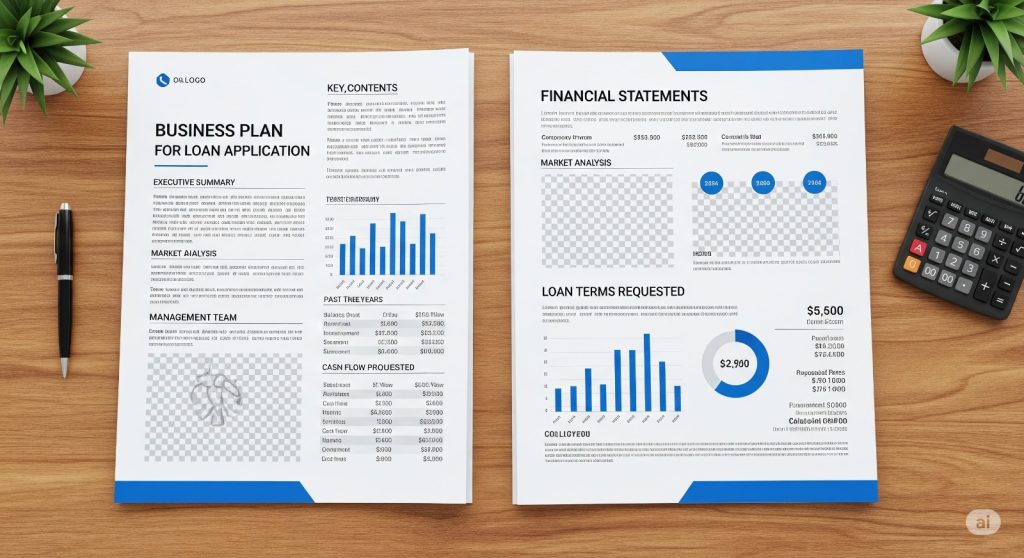

Market Analysis: Pretend You Stalked Competitors Without Actually Leaving Your Couch

Nothing says “bankable” like data. The more numbers you throw at your loan officer, the more likely they are to believe you didn’t just make them up (even though…).

Include:

- Your actual market—no, “everyone with Wi-Fi” is not a target

- Demand: Show numbers (Forbes stats, Bureau of Labor Data, your own focus groups a.k.a. two friends and your roommate)

- Competitors: Name at least one real rival, even if it’s “Steve’s Pizza Palace” down the street

- Your edge: “We use memes in advertising” probably won’t fly, but “competitive pricing” might

If you can squeeze a pie chart in here, do it. Pie charts = effort. Banks love effort.

Life hack: Say “market share” a few times and the bank will assume you know what you’re talking about.

Operations Plan: The Stuff You Pretend Won’t Fall Apart on Day One

Banks want to know your business won’t combust the second you get your check.

Key bits for your Business Plan:

- Where does inventory come from? (“Amazon” is not always an appropriate answer, but it’s honest.)

- Who handles operations? List everyone (including yourself, your cousin, and that reliable freelancer you met in a Reddit thread)

- Logistics: How does stuff move, and what happens when it breaks? At least suggest you have a “contingency plan” (fancy term for “call mom, panic, Google solutions”)

- Regulatory issues: Zoning, permits, health codes—list them to sound legit, even if you’re learning them as you go

Admit nothing, project confidence. The words “systematic process” can cover a multitude of sins (and sticky notes).

Marketing and Sales: Convincing the Bank You Know People Will Show Up

You can’t just build it and hope people wander in (unless you’re that guy who owns every Main Street pizza joint). No, friend, you need a plan.

Options you should mention:

- Digital marketing (socials, PPC—yeah, just like “the big guys”)

- Traditional marketing (flyers on lampposts no one reads, but banks pretend to respect)

- PR campaigns (“If we’re lucky, maybe a TikTok about our store goes viral and we don’t have to pay rent”)

- Partnerships: If you know someone with a food truck or a cousin in real estate, drop their name

Include a projected customer count (make it believable—not “1 million in Q1 unless Dogecoin moons again”).

Reminder: “Word of mouth” is only bank-acceptable if you also mention actual, traceable sales tactics.

Financials: The Section Where You Boldly Predict the Future (With Little to No Evidence)

Numbers! Banks require fake optimism, formatted in Excel. This is where your Business Plan earns that “bank ready” sticker.

You must, must, must include:

- Startup costs: List actual numbers. If it looks suspiciously round ($10,000 for “supplies”), add detail (“$497.32 for branded coasters”).

- Revenue predictions: Pretend you know how math works, and your line never goes down.

- Break-even analysis: Estimate the month you’ll stop bleeding cash—even if it’s after the next presidential election.

- Cash flow statement: Even if the inflows are just “loan from the bank, thanks.”

- Loan ask: Be blunt. How much, for what, and how fast can you pay it back? Assume the bank will harass you the second you’re late.

If you’re tempted to add “miscellaneous: $5000” just—don’t.

Banks are like your parents: they want receipts, and they WILL ask embarrassing questions if your numbers don’t add up.

The Appendix: The Resting Place for Everything You Couldn’t Force Into Other Sections

Don’t overthink it. Dump in:

- Relevant business licenses

- Permits you overpaid for

- Fancy “letters of intent” from partners who may ghost you

- Your résumé (stretch as needed: “Founder” sounds better than “Pinterest Visionary”)

- Charts, maps, and that one photo where you look the least desperate

No one reads the appendix, but if you don’t have one, the bank will absolutely notice.

Conclusion: Congratulations—The Loan (And Your Last Ounce of Sanity) Is Almost Within Reach

You’ve just created the bank-approved Business Plan of your nightmares, filled with numbers, buzzwords, and hope. Will this document change your life? Absolutely—mostly by giving you carpal tunnel from typing and new respect for anyone who ever finished one sober.

If you survive submitting your plan and actually get funded, treat yourself to extra espresso (from somewhere fancier than your kitchen). If you made it here without throwing out your laptop, you might even be ready for a board meeting—and that, my friend, is the real American dream.